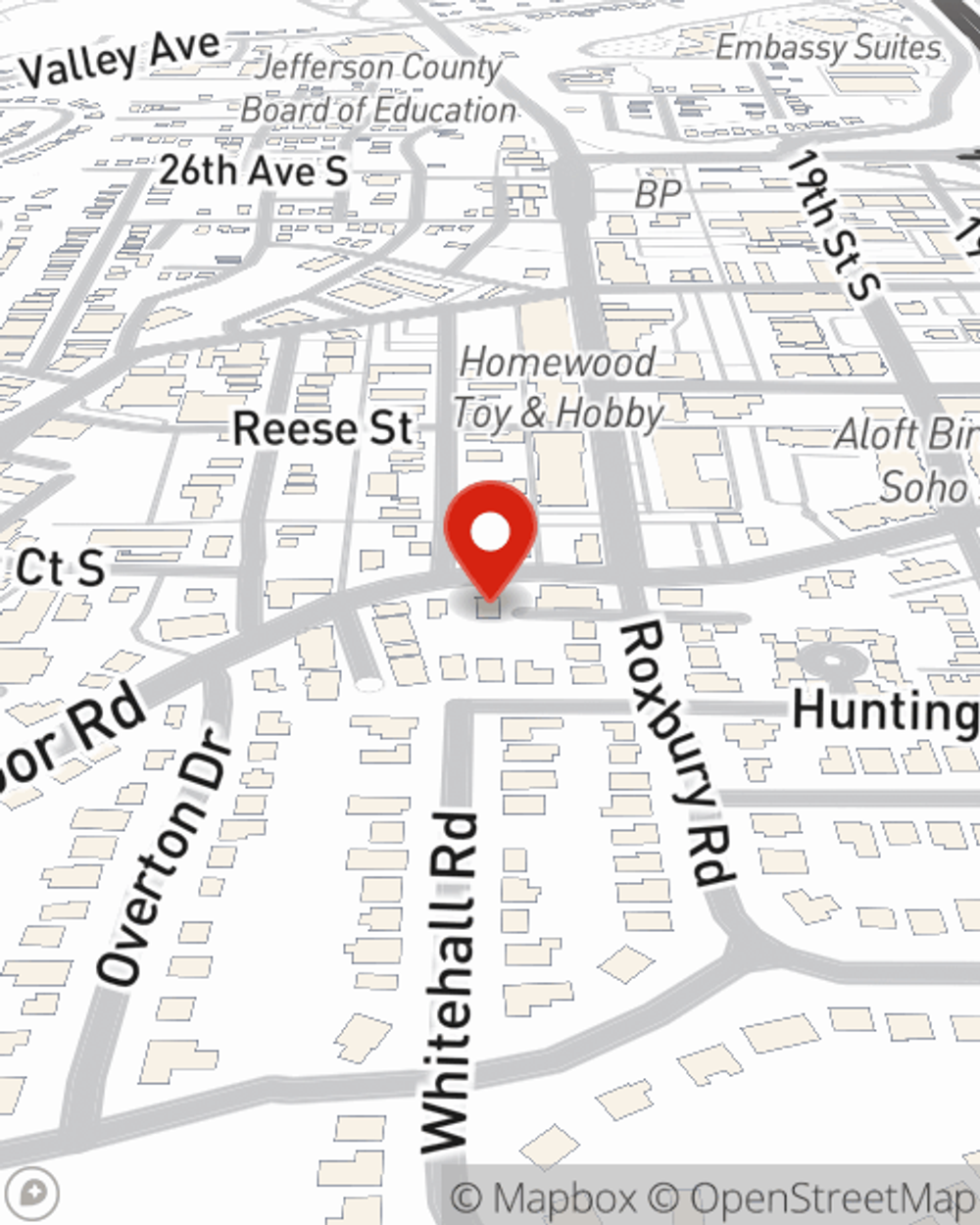

Renters Insurance in and around Homewood

Your renters insurance search is over, Homewood

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

There's a lot to think about when it comes to renting a home - location, internet access, size, apartment or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Your renters insurance search is over, Homewood

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

When the unanticipated theft happens to your rented apartment or condo, usually it affects your personal belongings, such as a set of golf clubs, a microwave or a cooking set. That's where your renters insurance comes in. State Farm agent Tim Johns is dedicated to help you evaluate your risks so that you can protect yourself from the unexpected.

Call or email State Farm Agent Tim Johns today to discover how a State Farm policy can protect items in your home here in Homewood, AL.

Have More Questions About Renters Insurance?

Call Tim at (205) 870-8400 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.