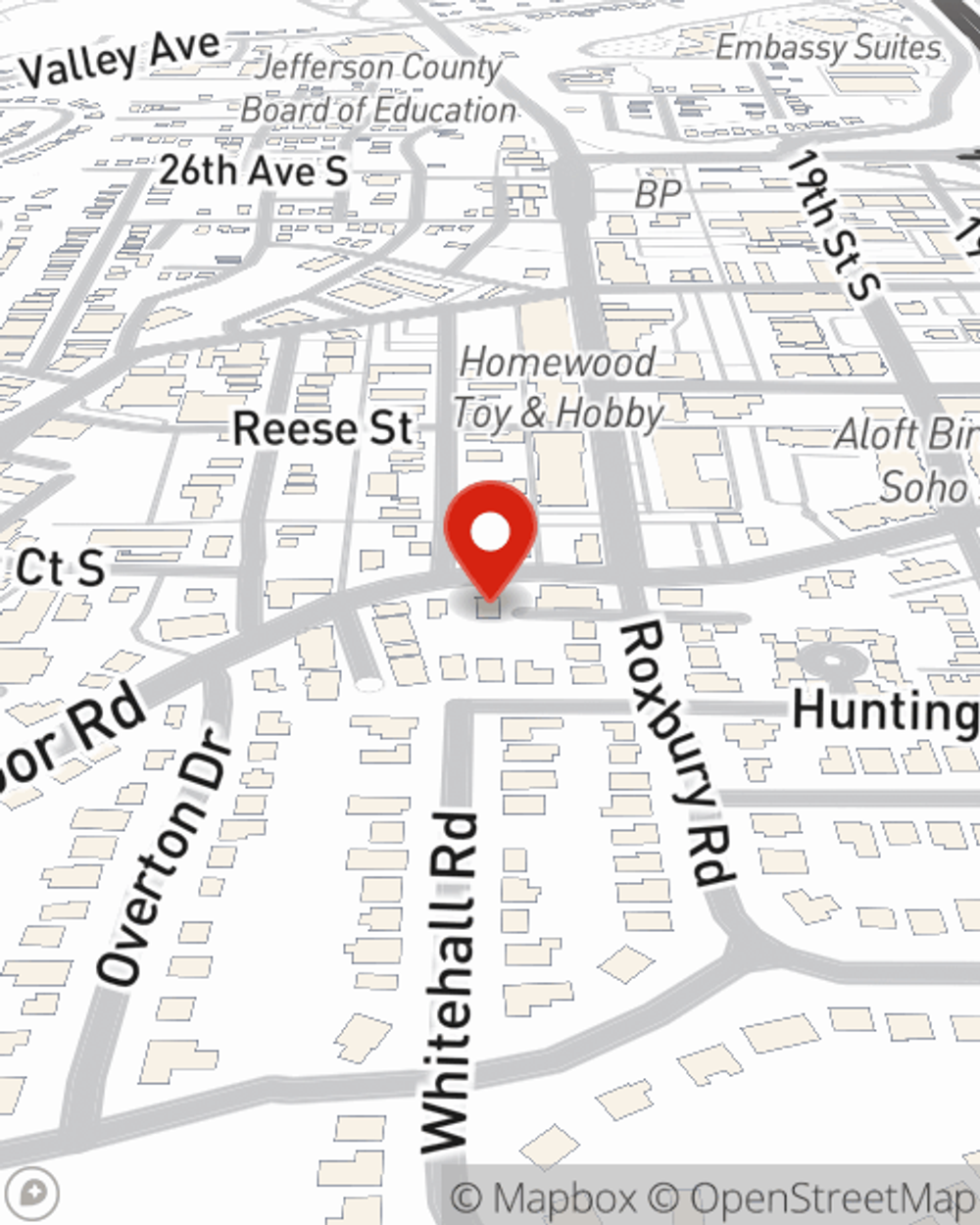

Condo Insurance in and around Homewood

Welcome, condo unitowners of Homewood

State Farm can help you with condo insurance

Your Stuff Needs Insurance—and So Does Your Condo.

The life you are building is rooted in the condo you call home. Your condo is where you relax, unwind and kick back. It’s where you build a life with the ones you love.

Welcome, condo unitowners of Homewood

State Farm can help you with condo insurance

Condo Unitowners Insurance You Can Count On

We know how you feel. That's why State Farm offers fantastic Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Tim Johns is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

Ready to learn more? Agent Tim Johns is also ready to help you see what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Tim at (205) 870-8400 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.